|

Author: James Kennedy, Technology Analyst at IDTechEx Mycelium first came to prominence with its use in sustainable packaging. Several startup companies, such as Ecovative, received strong investments to develop the technology. Not long after, some companies realized the potential of mycelium to be used as a leather-like material. Companies have since expanded their focus to make mycelium leather a reality. Ecovative has produced Forager and Bolt Threads developed Mylo. Several other significant players have since entered the scene, notably MycoWorks and Mirum, all aiming to bring the first mass-produced mycelium leather to market. Significant recent developments in the industry mark the beginning of large growth in the scale of production alongside major setbacks in this nascent technology, highlighting the challenges that must be overcome to achieve market growth. An extensive breakdown and analysis of mycelium technology, market players, and outlook alongside other competing alternative leather materials are available in IDTechEx’s market report, “Emerging Alternative Leathers 2024-2034: Technologies, Trends, Players”.

|

||

|

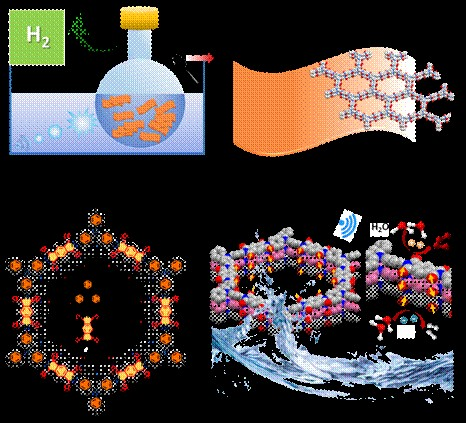

The production process of mycelium leather. Source: IDTechEx |

||

|

The potential of mycelium leather Mycelium leather has the potential to offer a durable, plastic-free, and animal-free alternative to both synthetic and animal leather. Alongside the other major emergent leather alternatives of plant-based leather, microbial leather, and lab-grown leather, mycelium leather must differentiate itself and compete on price to succeed. Vertical farming of mycelium can maximize the efficient use of resources. One of the primary advantages is the ability to be highly space efficient, meaning that mycelium can be cultivated in a much smaller area than other crops. Even vertical farming of plants is a far more challenging endeavor, requiring high amounts of energy and infrastructure to provide light to the plants. Given the nature of mycelium, this can be avoided. Other advantages include low water requirements and efficient delivery of nutrients, which help to reduce environmental impact. At the same time, a highly controlled environment could allow for uninterrupted year-round cultivation. The cultivation of the mycelium in the same plant where processing takes place could reduce the cost and impact of transportation. On the other hand, keeping growth mediums sterile, controlling conditions, and choosing the correct strain add to the complexity of this process. The ability to provide a consistent and unblemished product is also key. Many companies have invested in the development and selection of the best mycelium strains for production, ones that grow at a fast rate without compromising final material properties. Investment in scaling vertical farming for mycelium is one of the major challenges for the mycelium industry. Many plant-based leather alternatives that are competing with mycelium leather don’t face this issue, as they utilize agricultural waste or other plants that are already grown on a large scale. Another major challenge for mycelium leather is price, which is intrinsically connected to the challenges of scaling. While scaling is expected to reduce prices, mycelium leather producers will have to fight to optimize their production and prove to potential customers that prices competitive with animal leather can be achieved. While there are many challenges to overcome, once the growth and cultivation processes for mycelium have been optimized and scaled, there is scope for mycelium leather to provide a plastic-free, durable, versatile, and animal-free leather alternative that can answer the demands of consumers. Major developments in the mycelium leather sector 2023 was a significant year in the leather alternative market, with several key developments highlighting strong opportunities alongside some notable challenges. However, IDTechEx’s outlook for the emerging alternative leather market is positive. For mycelium leather, it has been a mixed year. Bolt Threads, who produce a range of sustainable materials, including their mycelium leather product Mylo, announced in 2023 that they would be suspending production indefinitely. For one of the highest-funded companies attempting to bring mycelium leather to market, it highlights the challenges of bringing this technology to mass production. However, MycoWorks also opened a new factory in South Carolina, USA in September 2023. According to MycoWorks, their factory can produce millions of square feet. Whether MycoWorks can scale this production will be a key test for the mycelium industry. Success here could prove mycelium to be a viable technology to penetrate the incumbent leather market. For further information on this market, including discussion on over 70 players, analysis of numerous vegan bio-based leathers, and a 10-year market forecast, see the IDTechEx market report, “Emerging Alternative Leathers 2024-2034: Technologies, Trends, Players”. For more information on this report, including downloadable sample pages, please visit www.IDTechEx.com/AltLeather. For the full portfolio of sustainability research available from IDTechEx, please visit www.IDTechEx.com/Research/Sustainability. |